- The Bread Bin

- Posts

- Markets are nervous and when markets get nervous, that’s when we lean forward.

Markets are nervous and when markets get nervous, that’s when we lean forward.

Markets are twitchy: the Bank of England may ease off bond sales, the Fed might cut rates, and Aldi keeps building stores, while AstraZeneca hits pause. Here’s what the breadwinners are asking this week.

Last week was all about rising borrowing costs and cautious companies. This week, investors are hanging on central bank decisions in London and Washington, while trying to decode whether corporate “pauses” are prudence or panic.

Why it matters

Bank of England slowing Quantitative Tightening (QT):

For two years, the Bank of England has been selling off £100 billion of government bonds a year. Markets are creaking, so they may cut that pace by a third.

In simple terms, the Bank has been dumping bonds; now it may just drip them out. Fewer bonds hitting the market could steady UK borrowing costs.US Federal Reserve rate cut watch:

Across the pond, the Federal Reserve could trim rates by 25 basis points (that’s 0.25%). If confirmed, it loosens global liquidity which is a relief for debt laden firms and shaky borrowers everywhere.

Corporate caution vs. confidence:

AstraZeneca just hit pause on a £200 million research hub in Cambridge. Aldi, meanwhile, saw profits fall 21% yet is still building 80 new stores. And AO World is buying back shares. Three signals, three very different stories.China’s slowdown:

August data disappointed: weak retail, industry, and property. When China sneezes, commodities catch a cold and Jim Rogers would be checking copper prices before breakfast.

Investors rationale

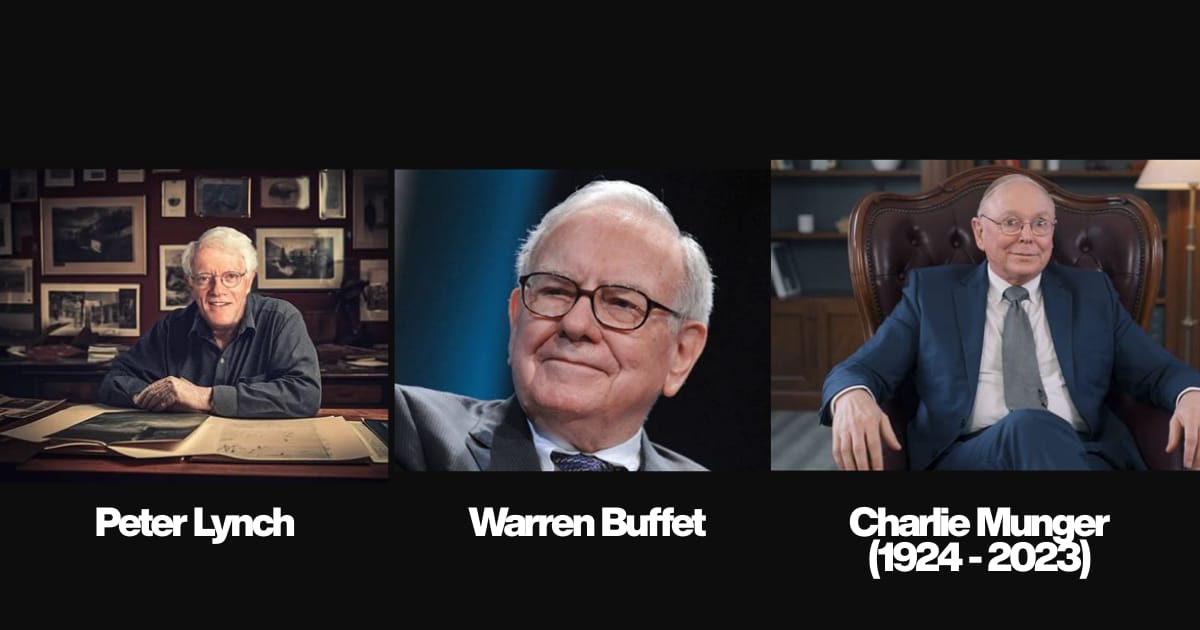

Warren Buffett once said - “Be fearful when others are greedy, greedy when others are fearful.” Bond panic may be breeding bargains in cash rich UK small caps.

Charlie Munger piped up - “It takes character to sit with cash and do nothing.” If AstraZeneca’s pause spooks investors, it might be wise to wait for clarity.

Peter Lynch - “Go for a business any idiot can run.” Aldi’s relentless expansion, despite lower profits, fits the bill.

Historically Lynch, Buffett and Munger have shown that the best investments often sit in plain sight, in the shops you visit, the brands you trust, and the businesses you understand.

Evidence & metrics

30 year gilt yields: 5.7%, highest since 1998

(UK Debt Office, Sept 2025).Bank of England Quantitative Tightening pace: £100bn/year → £67.5bn/year (Reuters poll, Sept 2025).

US Fed: 25 basis points cut expected this week

(Economist survey, Sept 2025).Aldi UK operating profit: £435.5m, down 21% YoY

(company report, Sept 2025).AstraZeneca: paused £200m Cambridge R&D hub

(Reuters, Sept 2025).

Risks & counterpoints

Bear case: Inflation refuses to fall which is forcing the Bank of England to tighten further and crushing fragile growth.

UK government borrowing costs stay high which crowds out any financial flexibility before the autumn budget.

China slowdown worsens which is dampening commodity demand and hurting exporters.

There’s a lot going on in the world right now, so being cautious isn’t a bad thing.

What a smart investor would do next

Watch the Bank of England’s tone on Thursday and not just the decision, but how they talk about inflation and bond sales.

Prepare watch lists of low debt, high moat firms trading near book value. Especially domestically focused names.

Keep dry powder ready, whether for African banks below P/B 1, or UK small caps if panic deepens.

Already subscribed, then you don’t have to do anything except enjoy our great content.

If you haven’t subscribed yet and want more filtered insights before the market reacts? Sign up to the weekly newsletter now for the full playbook.

Quick favour - what part of today’s post stuck with you? The charts, the story, or the takeaway? If you think a mate would get something out of it too, hit the share button at the top of the page and pass it on. We’re trying to give as many people as possible, the chance to make their money work harder.

⚠️ Disclaimer:

This is for educational purposes only, and is not financial advice. Always do your own research before making investment decisions.