- The Bread Bin

- Posts

- What We Noticed in August’s Market Jitters

What We Noticed in August’s Market Jitters

China cooled, U.S. costs crept higher, and markets wobbled. That’s when bargains usually hide in plain sight.

We never chase hype, instead we look for bargains when the rest of are panicking. August served up plenty to worry about: China’s economy is cooling, U.S. costs are creeping higher, and trade tensions rumble in the background.

Most investors just see storm clouds. However serious breadwinners, would be asking where are strong businesses being marked down unfairly, simply because the headlines are grim?

Why it matters

China’s slowdown is real. Factories grew output by just over 5% in August, and retail sales barely cleared 3% growth. That’s sluggish for an economy that used to churn out double digit numbers. Property markets are still shaky, so households don’t feel rich, which makes them spend less.

Meanwhile in the U.S.A, the price of imported consumer goods and machinery ticked up. That means businesses are paying more to bring things in, even though energy and food prices have eased a little.

At the same time, American shoppers surprised everyone because retail sales rose 0.6% in a month, with online shopping and back to school gear leading the way. People are still spending, even if it costs more.

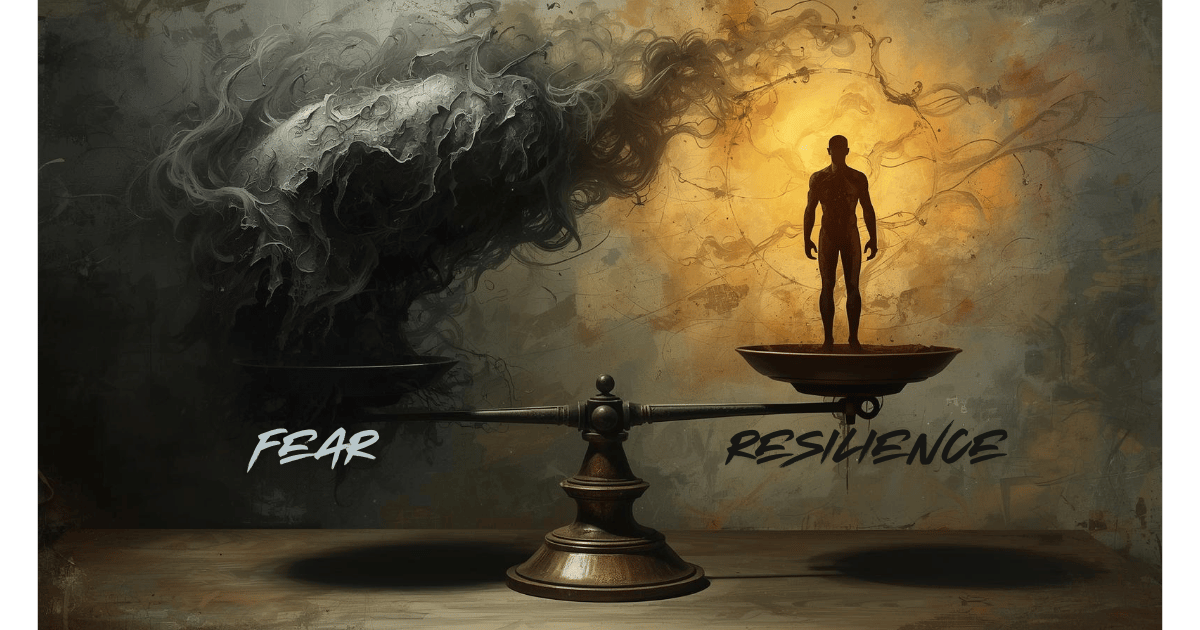

Globally, markets didn’t collapse. Stocks crept up around 2.5% in August, bonds about 1.5%. Not fireworks, but not a crash either. This mix of fear and resilience is exactly where breadwinners will thrive.

Investor Rationale

Instead of focusing on who might go bust, let’s flip it and research which companies are priced like they’ll fail, but probably won’t?” That’s where the bargains hide.

Spend some time establishing are any global giants, (think consumer staples or insurers) selling for less than their long term worth. We love cash flows that keep rolling in, no matter the weather.

Keep your eyes peeled, for everyday shops which are still busy. Are people still tapping their phones to buy groceries? If yes, then maybe the gloom is louder than reality.

Evidence & metrics

China retail sales grew just 3.4% year on year, while factory output crawled at 5.2%. In simple terms: that’s weak by their standards.

U.S. retail sales rose 0.6% in August (and 5% compared to a year ago), with e-commerce and clothing leading the charge.

Import prices for consumer and capital goods climbed 0.5%, hinting that inflation isn’t done yet.

Global stocks edged up 2.5%, bonds around 1.5%. Emerging markets held up better than expected. Think of it this way: the world isn’t booming, but it isn’t falling apart either. This is a close watch for active breadwinners because there’s a lot happening in the world right now.

Risks & Counterpoints

Sticky inflation: If these cost rises stick, central banks may hold off cutting interest rates (think of the ongoing rift with the Trump administration and the federal reserve) or even raise them again. That keeps borrowing expensive.

Trade tensions: U.S. tariffs and China’s weak exports could easily turn into a bigger drag on global growth. There’s worry baked into the market these days, so take this into account.

Value traps: Some companies look cheap because they’re genuinely in trouble. Low margins, bad management, or poor governance can eat away any “bargain.” Be vigilant.

What a smart investor would do next

Keep it simple. Look at companies that sell everyday basics, have little debt, and keep the lights on even when the economy slows.

Check pricing power. If import costs keep rising, who can pass that on to customers without losing them? That’s who you want to own.

Shop globally. Don’t just stick with U.S. stocks, there’s plenty other markets which are cheaper and still solid. Not all investors, but a focused subset would happily buy where everyone else is ignoring.

Already subscribed, then you don’t have to do anything except enjoy our great content.

If you haven’t subscribed yet and want to cut through the noise? Get more of these bite sized investing insights. Sign up for the free newsletter today.

Quick favour - what part of today’s post stuck with you? The charts, the story, or the takeaway? If you think a mate would get something out of it too, hit the share button at the top of the page and pass it on. We’re trying to give as many people as possible, the chance to make their money work harder.

⚠️ Disclaimer:

This is for educational purposes only, and is not financial advice. Always do your own research before making investment decisions.